The Permanent Account Number (PAN) is a crucial identity tool for individuals and businesses in India. Since its introduction in 1972, it has served as a unique identification number for taxpayers, facilitating smooth tax transactions, financial services, and regulatory compliance. But with the digital revolution and increased focus on data security and financial transparency, the Indian government has launched an upgraded version: PAN 2.0. This blog explores the key features of PAN 2.0, how it improves upon the old system, and what it means for taxpayers.

What is PAN 2.0?

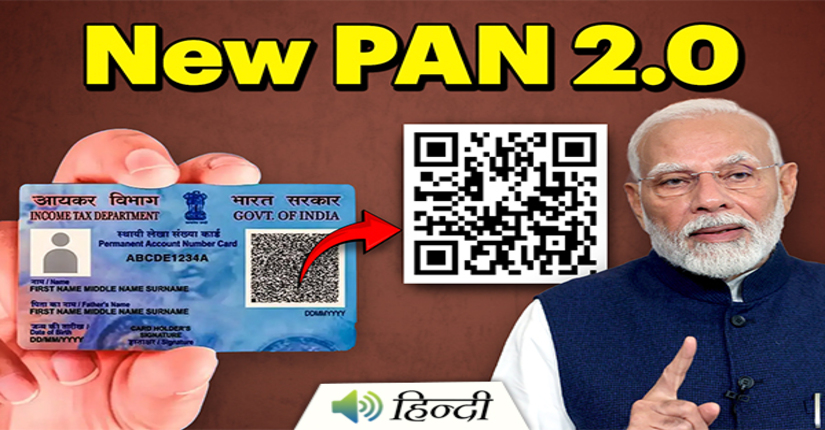

The Indian government unveiled PAN 2.0, a next-generation PAN system that improves on the original PAN system by adding more security features, accessibility, and database integration. Its main goals are to increase tax law compliance, lower fraud, and provide taxpayers with a more convenient experience. PAN 2.0 is a component of India’s larger initiative to build a strong financial ecosystem and digitize the country. PAN 2.0 introduces a variety of enhancements and modernizations to keep up with technology changes, while maintaining the fundamental purpose of the original PAN system, which was to act as an identity number for people and companies in the tax system.

Key Features of PAN 2.0

1. Aadhaar Integration: PAN 2.0 is integrated with Aadhaar, ensuring unique identification, eliminating duplicates, and improving tax data accuracy.

2. Biometric Data Integration: The inclusion of biometric verification via Aadhaar strengthens identity verification and reduces fraud.

3. More Secure Data Storage: Advanced encryption and secure data storage techniques protect personal and financial information, safeguarding against cyberattacks.

4. Digital PAN: PAN 2.0 offers a digital version that can be downloaded from the official website, featuring an encrypted QR code for added security.

5. Improved Accessibility and User Experience: The system offers a user-friendly interface, easier access to services, and mobile optimization, particularly benefiting those in remote areas.

6. Real-Time Updates: PAN 2.0 allows immediate updates to personal information, improving accuracy and ensuring up-to-date records.

How PAN 2.0 Benefits Taxpayers

1. Enhanced Security

The addition of biometric data and Aadhaar integration means that identity theft will be harder to perpetrate. The secure storage and encryption of personal data also reduce the risk of hacking and unauthorized access, giving individuals greater peace of mind.

2. Simplified Application Process

With the online application process now more streamlined, obtaining a PAN card is easier than ever before. Aadhaar linking speeds up the process, and with digital PAN cards available, applicants no longer need to wait for a physical card to be mailed.

3. Faster Tax Filing and Refunds

PAN 2.0 will significantly improve the efficiency of tax filing and processing refunds. Since the system is better integrated with other databases and uses real-time updates, tax authorities can process returns faster. This will help individuals and businesses receive their refunds without unnecessary delays.

4. Easier Compliance

With the advent of digital PAN cards, linking with Aadhaar, and more accessible features, taxpayers will find it easier to comply with tax regulations. This encourages greater participation in the formal economy, increasing tax revenue and improving overall financial transparency.

Conclusion: The Future of PAN 2.0

PAN 2.0 is a major improvement over the original PAN system, using new technology that guarantees increased efficiency, security, and accessibility. The Indian government is laying the groundwork for a more safe and open financial ecosystem by streamlining processes, integrating Aadhaar, and putting strong security measures in place. PAN 2.0 is more than just an update for both individuals and companies; it is a crucial advancement in India’s financial and digital revolution. Staying abreast of these developments will guarantee that taxpayers experience a more seamless and secure process when handling tax-related issues.